Fortune at the Foundation: Why the Next Billion-Dollar Opportunity Lies in Solving Fundamental Problems

As humans, we are drawn to flashy things like mosquitoes. We want to hop on the latest trend, catch the buzzword, or bet our savings into coins because of FOMO.

It is no different in business. Entrepreneurs are always on the hunt for the new thing. Even though sometimes this works, today’s story provides a fresh, counterintuitive argument: Solving fundamental human problems is always a good idea.

Today we’ll dive into M-Pesa. But before that, I would like to thank Sarah Kelsey for providing the idea. I joined her for a podcast episode, and to celebrate the collaboration, asked for the next newsletter’s deep dive.

Sarah hosts the OneUp Project, a podcast where she unpacks fresh perspectives and thought-provoking insights every week - with her own lovely style.

You can check her work from the following links;

The Financial Desert: When Traditional Banking Failed Millions

So What is M-Pesa? Launched in 2007 by Safaricom (Kenya's largest telecom provider), M-Pesa is a mobile money service that allows users to store and transfer money using only their mobile phones.

The name combines "M" for mobile and "Pesa," the Swahili word for money. The service enables users to deposit money into an account stored on their cell phones, send money to others via secure SMS, and redeem deposits for cash through a network of agents.

Without requiring bank accounts or smartphones, M-Pesa effectively turns basic mobile phones into pocket-sized banks.

In 2007, Kenya's financial landscape presented a stark reality: over 80% of the population had no access to formal banking services. This wasn't just an inconvenience—it was a massive economic barrier. Without bank accounts:

Sending money to family in rural areas meant entrusting cash to bus drivers or friends

Savings were kept under mattresses, vulnerable to theft

Building a credit history was impossible

Small businesses couldn't access capital to grow

Traditional banks viewed this market as unprofitable. The cost of establishing physical branches across Kenya's diverse geography was prohibitive. The average transaction size would be too small. The documentation requirements would exclude most potential customers.

The conventional wisdom was clear: banking the unbanked wasn't just difficult; it was financially unviable.

The Invisible Network: How Mobile Phones Became Africa's Financial Backbone

While Kenya lacked banking infrastructure, it had something else: widespread mobile phone adoption. By 2007, over 30% of Kenyans owned mobile phones—a number growing exponentially while banking access remained stagnant.

Safaricom, Kenya's largest telecom provider, had an insight that would redefine financial services: What if mobile phones could become banks?

This a-ha moment came from recognizing three critical truths:

Trust already existed in different forms. Kenyans had developed informal financial networks based on community relationships. What they lacked wasn't trust—it was efficient infrastructure.

Simple technology could replace complex infrastructure. A basic SMS system could facilitate transactions without requiring sophisticated banking platforms.

Mobile penetration was creating an overlooked opportunity. The rapid adoption of mobile phones had established a network that could be repurposed for financial services.

Mind you - don’t think this with today’s Western lenses. At the time, mobile banking wasn’t popular - even in developed countries.

The Billion-Dollar Blueprint: Harvesting Value Where Others See Obstacles

M-Pesa's story reveals profound principles about premium value creation that extend far beyond mobile money:

1. Fundamental Problems Hide Opportunities

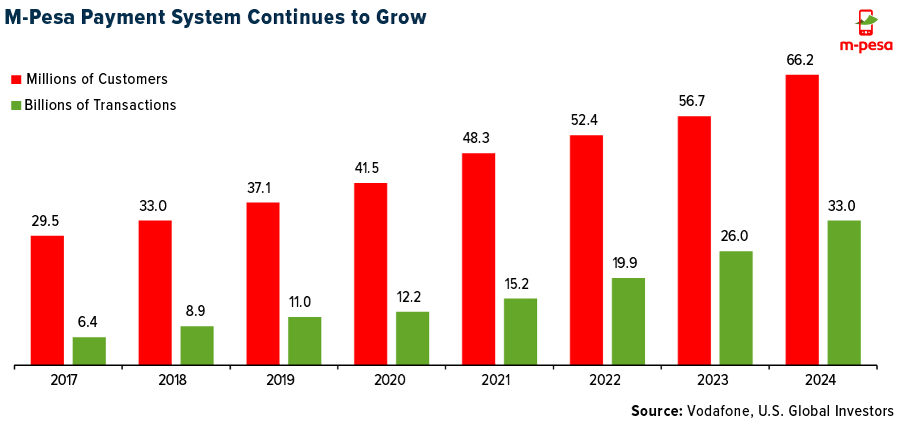

M-Pesa has processed transactions worth over 50% of Kenya's GDP annually. What began as a simple money transfer service has evolved into a sophisticated financial ecosystem including savings, loans, and international remittances.

By 2021, Safaricom was generating over $700 million in annual revenue from M-Pesa—proving that solving fundamental problems can create enormous financial value.

There is literally unlimited wealth to be made in basic human needs. The more fundamental the problem, the more valuable its solution becomes.

2. Trust Is the Ultimate Currency

In markets with fragile institutions, trust becomes an extraordinarily valuable asset. M-Pesa's brilliant move was not creating a new currency but monetizing and scaling existing trust networks.

M-Pesa agents—often small shopkeepers—became the human interface for a digital system, combining technological efficiency with familiar face-to-face interactions. This hybrid approach allowed M-Pesa to achieve what banks couldn't: widespread trust at a fraction of the infrastructure cost.

3. Simplicity Creates Premium When It Enables the Previously Impossible

M-Pesa's initial interface was remarkably simple: SMS messages with basic commands. This simplicity wasn't a limitation—it was the key to adoption. By designing for the most basic phones and minimal technical literacy, M-Pesa achieved what sophisticated banking apps couldn't: universal accessibility.

So it is obvious that premium doesn’t always mean sophistication. Sometimes, the ability to make something complex radically simple creates the greatest value.

4. Controlled Growth Maintains Value

M-Pesa's expansion was methodical. Rather than immediately pursuing multiple countries or services, Safaricom focused on establishing dominance in Kenya before expanding. This controlled growth allowed them to:

Build network effects that made competition increasingly difficult

Refine their model based on real user behaviors

Establish regulatory relationships that became competitive moats

Develop the trust and reliability that became their premium marker

We saw this with more premium brands. Strategic limitation can create more value than rapid expansion. It was what Aman Resorts and Le Labo did.

Mining for Gold: Uncovering Your Own Fundamental Market Gap

How can businesses apply these principles to create premium value in their own contexts?

Seek overlooked infrastructure. What existing networks or technologies could be repurposed to solve fundamental problems?

Identify trust gaps. Where do institutional weaknesses create opportunities for trusted intermediaries?

Focus on fundamental frictions. What basic activities are unnecessarily complicated or inaccessible?

Look beyond obvious markets. The most valuable opportunities often exist in markets others have deemed unprofitable.

Design for actual constraints. Creating value in challenging environments requires embracing limitations rather than fighting them.

The Deeper Meaning: Profit and Purpose Are Not Opposing Forces

Perhaps the most profound lesson I learned from M-Pesa is that social impact and financial success aren't necessarily opposing forces—they can be perfectly aligned. By solving a fundamental societal problem, Safaricom created more value than if they had pursued profit alone.

You don’t have to be purely capitalistic or charitable to create value for the society. M-Pesa proves an alternative path: businesses can generate extraordinary returns by solving real human problems.

The model suggests that the most sustainable premium positions aren't built on artificial scarcity or status games, but on creating genuine utility where none existed before.

As markets mature and consumers grow more discerning, this alignment of profit and purpose may be the most powerful premium strategy of all—not because it sounds good, but because it works.

What fundamental problem could your business solve?